When people hear that homes are expected to appreciate around 3% annually over the next several years, the natural question is: “What’s the point if I’m paying 6% interest on my mortgage?”

It’s a smart question — but here’s why that concern doesn’t tell the whole story.

- Appreciation compounds on the entire home value.

If you buy a $1,000,000 home with 20% down, you’re investing $200,000. A 3% appreciation rate adds about $30,000 in the first year — a 15% return on your down payment — regardless of your loan rate. - You’re also paying down principal.

Every month, part of your payment goes toward lowering the loan balance. That means you’re building equity in two ways: appreciation + loan paydown. Over the years, the equity created through amortization can be substantial. - Interest rates can change — but appreciation you miss is gone forever.

If rates fall, you can refinance to lower your monthly cost. But if you delay buying, you miss out on the equity growth that compounds year after year. For example, waiting even two years at 3% appreciation could cost you over $60,000 in lost growth on a $1,000,000 home. - Housing isn’t just an investment — it’s a hedge and a home.

Unlike rent, your mortgage locks in housing costs, provides stability, and benefits from tax advantages. Even at higher rates, ownership puts your money to work in multiple ways that renting never can.

Bottom Line:

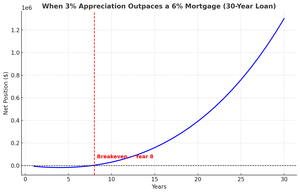

A 6% mortgage doesn’t “cancel out” appreciation — it’s part of a bigger picture. Appreciation, loan paydown, and the option to refinance later all work together to make homeownership a powerful wealth-building tool. Take a look at the graph below.

- Blue line = net position over time (equity minus interest).

- Dashed red line = breakeven point at ~Year 8.

Additional Factors to Keep in Mind:

- Tax Benefits: Mortgage interest is often deductible, which softens the real cost of interest (depending on your personal tax situation).

- Locked-In Property Taxes: Buying now also fixes your property tax basis. In states like California, Prop 13 caps how much your assessed value can increase each year — meaning your tax bill grows slower than the market value of your home.

- Conservative Assumptions: This model assumes only 3% appreciation (the long-term historical average) and that the mortgage rate stays at 6% for the full 30 years. In reality, appreciation may run higher, and many homeowners refinance into lower rates later, improving the breakeven timeline.

Thinking about buying but worried about today’s rates?

Every homeowner’s situation is unique, and the numbers often look better than you think once appreciation, loan paydown, and tax advantages are factored in. Let’s run the numbers for your specific goals and see if it makes sense to buy now—or to wait.

📲 Contact me today for a free, no-obligation consultation.